Medicare is a government health care coverage program for individuals 65 and more seasoned, individuals under 65 with specific disabilities and individuals of any age with end-stage renal sickness. Medicare is somewhat supported by finance charges from most managers, representatives, and all individuals who are independently employed. The Medicare program offers essential inclusion to help pay for things like specialist visits, emergency clinic stays, and medical procedures.

Medicare is broken out into four sections.

- Medicare Part A (clinic inclusion): Covers things like inpatient medical clinic stays, home human services, and talented nursing office care.

- Medicare Part B (clinical inclusion): Covers things like specialist visits, outpatient administrations, and indicative screenings.

- Medicare Part C (Medicare Advantage): Medicare Advantage plans are offered through private medical coverage organizations. At the point when you join a Medicare Advantage plan, you despite everything have Medicare. The thing that matters is the arrangement covers and pays for your administrations rather than Original Medicare. These plans must give a similar inclusion as Original Medicare (so you’re not passing up anything) and can likewise offer additional advantages.

- Medicare Part D (physician recommended sedate inclusion): Only offered through private wellbeing plans. Medicare Parts A and B

Parts A and B are known as Original Medicare. This is the most essential inclusion you can get.

Parts C and D are accessible through private wellbeing plans. They’re the two different ways to upgrade your human services included if you need more than what Original Medicare offers.

Aetna Medigap is Medicare Supplement Insurance that helps fill “holes” in Original Medicare and is sold by privately owned businesses. Unique Medicare pays for a lot, yet not all, of the expense for secured social insurance administrations and supplies. A Medicare Supplement Insurance (Medigap) strategy can help pay a portion of the rest of the medicinal services costs, as:

- Copayments

- Coinsurance

- Deductibles

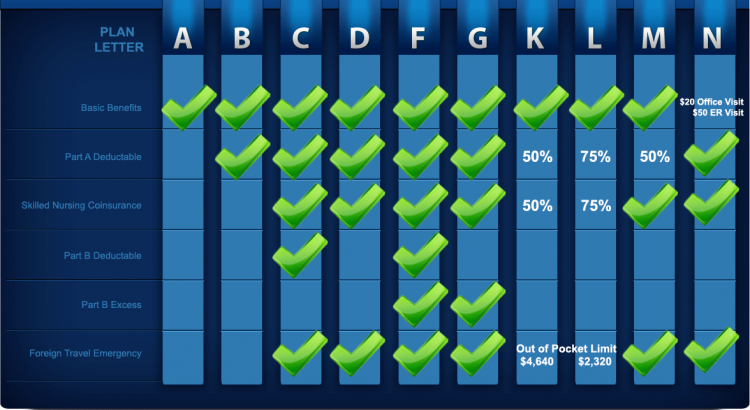

10 Medigap Policies give inclusion normalized by Federal and State laws for your security. A few insurance agencies offer these choices. The decisions and expenses change starting with one transporter then onto the next. The plans offered likewise rely upon which state you live in.

Aetna is a CVS Health organization that assists individuals with settling on choices about their human services and their medicinal services spending. It offers unique Medicare and Aetna Medigap (supplement) plans, for example, deductibles and coinsurance, just as: dental, drug store, bunch life, and disability protection. This inclusion additionally permits you to pick your medical clinic and specialist. Aetna is devoted to helping individuals accomplish wellbeing and money related security.

| BENEFITS | F** | G | N† |

| Medicare Part A coinsurance and hospital costs (up to an additional 365 days after Medicare benefits are used) | 100% | 100% | 100% |

| Medicare Part B coinsurance or co-payment | 100% | 100% | 100% † |

| Blood (first 3 pints) | 100% | 100% | 100% |

| Part A hospice care coinsurance and co-payment | 100% | 100% | 100% |

| Skilled nursing facility care coinsurance | 100% | 100% | 100% |

| Part A deductible | 100% | 100% | 100% |

| Part B deductible | 100% | ||

| Part B excess charges | 100% | 100% | |

| Foreign travel emergency (up to plan limits) | 80% | 80% | 80% |

Aetna Medigap offers a wide exhibit of projects and administrations that help control rising representative advantages costs.

Endeavors to improve the nature of human services, for example, case the board, infection the executives and patient wellbeing programs, coordinated clinical, dental, pharmaceutical, conduct wellbeing, and inability data.

It likewise gives individuals straightforward data that can assist them with settling on better-educated choices about their wellbeing and budgetary prosperity.